On April 23, 2024, the U.S. Department of Labor (“DOL”) published its long-awaited final rule (“Final Rule”) that will update the salary thresholds for “white-collar” exemptions (e.g., executive, administrative, professional, outside sale, and computer employees) and highly compensated employees. In short, the Final Rule increases the base salary level required to qualify for the payment of an exempt salary by more than 20 percent, with that amount to increase further by January 2025 and thereafter.

By way of background, employees may be exempt from the Fair Labor Standards Act’s (“FLSA”) minimum wage and overtime protections if three tests are met:

- The employee must be paid on a salary basis, meaning they are paid a predetermined and fixed amount that is not subject to reduction because of variations in the quality or quantity of work performed;

- The employee is paid at least a specified weekly salary level; and

- The employee satisfies the primary duty test (i.e., primarily performs executive, administrative, or professional duties, as provided in the DOL’s regulations).

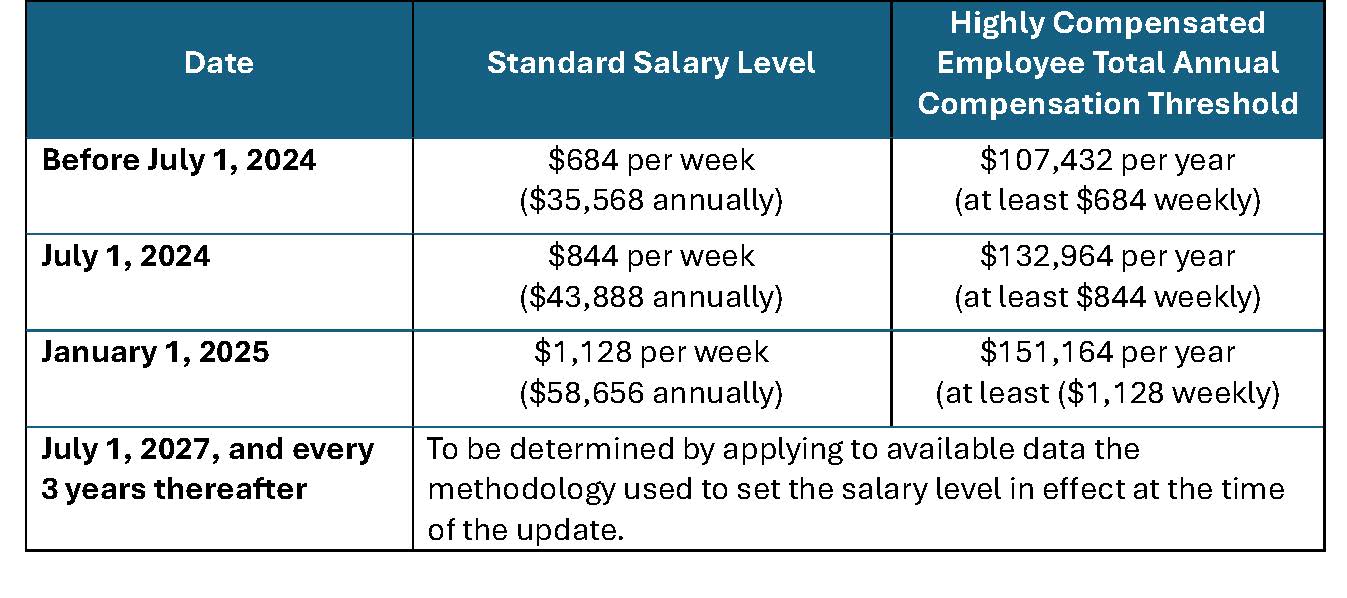

Currently, the salary threshold for the white-collar exemptions is $684 per week or $35,568 per year. The Final Rule will primarily impact employers in three main ways:

Salary Threshold Increase for White-Collar Exemptions. Under the new rule, the salary level threshold increases to $844 per week (equivalent to $43,888 annually), effective July 1, 2024, to be exempt from overtime compensation requirements.

Beginning January 1, 2025, the salary threshold rises to $1,128 per week (or $58,656 annually). This is nearly a 65 percent increase over the current salary requirement.

- Automatic Increases. Starting July 1, 2027, the Final Rule imposes automatic increases to the salary threshold every three years. The Obama administration previously attempted to impose automatic annual increases in 2016. However, the rule was challenged in court, during which a federal court judge in Texas blocked the rule from taking effect. The DOL stopped pursuing the 2016 rule at that time due to a change in presidential administration.

Judicial challenges to the new Final Rule are likely. However, employers should not count on the Final Rule being delayed or halted given the uncertain nature of litigation. Consequently, employers need to prepare for the Final Rule to take effect as planned.

- Highly Compensated Employees’ Salary Threshold Increase. The new rule also raises the total annual compensation threshold for “highly compensated employees” to $132,964 on July 1, 2024, and $151,164 on January 1, 2025. This is nearly a 14 percent increase.

To qualify as a highly compensated employee, employees must receive at least the minimum eligible salary per week ($684 from now until July 1, 2024; $844 from July 1, 2024 to January 1, 2025; and $1,128 January 1, 2025 until July 1, 2027) as a guaranteed salary but can earn the remaining portion of their annual compensation through payments such as bonuses, commissions, and other incentive payments.

Employers need to act quickly to make decisions regarding any employees impacted by the new rule to ensure compliance with the Final Rule.

Action Steps for Employers

Employees must be paid in compliance with both federal law and state law. Now is a good time for employers to:

- Evaluate current salaried positions for compliance with federal and state law. In addition to ensuring that salary payments meet the minimum requirements, now is a good time to consider whether other requirements for the “white collar” exemptions are being met. For example, to qualify for the “executive” exemption at the federal level, in addition to meeting the minimum salary requirement, the “employee must customarily and regularly direct the work of at least two or more other full-time employees or their equivalent.” (Several other requirements also apply.) As years pass, the responsibility associated with any given job may change. Positions that were previously supervising three or four workers year-round may now only supervise that many workers during the summer months or “construction season.” If all requirements for the exemption are not met, the worker must be treated as non-exempt and paid overtime if required.

- Consider whether your organization can afford to pay the new higher salary level to comply with the white-collar exemption requirements moving forward. From a business and financial perspective, employers must evaluate whether they are able to pay the higher salaries required to maintain the exemptions. Particularly where the exemptions imposed by the DOL are set to increase by over $23,000 per year by January 1, 2025, and are expected to rise with much greater frequency than in the past. Some employers may find it is not feasible to increase salaries at that rate. Employers need to consider whether it is more cost effective to change certain positions to non-exempt and pay the overtime rate when required due to the number of hours worked by the employee in that position. As a reminder, it is generally impermissible to shift back and forth between exempt and non-exempt status, so once a decision is made, an employer may find it difficult to change back quickly.

- Don’t forget the humans (a/k/a your employees) and the impact on labor relations. These types of legal changes can lead to difficult interactions between employers and employees. Increased salary requirements are often touted as wins for employees, and many workers do benefit. However, these changes also have a large impact on an organization’s budget and can lead to changes in business operations. For example, salaried workers may be changed to hourly employees or positions may be cut due to the inability to pay the higher salary requirements for a given job. Workers who are switched to hourly on non-exempt status may find that their income now varies from pay period to pay period, which can be difficult for families to adapt. Other employees may feel they were demoted when moved from salaried status to an hourly position. Additionally, some workers may not like having to track their hours worked and feel like they are being micro-managed after years in a salaried position that did not require tracking hours.

Again, the Final Rule takes effect July 1, 2024—leaving employers little time to determine how they will adjust to ensure compliance in the upcoming year and beyond. To limit unwanted employee turnover and angst, employers should approach any business operations changes – including those made to comply with the Final Rule – delicately and intentionally. For employers concerned about the Final Rule’s impact, there may be some legal considerations that can help mitigate negative effects to both employers and employees. For example, and perhaps most notably, employers need to take proactive steps and work with experienced counsel to navigate the legal and financial ramifications of the Final Rule. These ramifications may include pay adjustments or reclassifications of currently exempt employees who will not meet the Final Rule’s increased salary threshold. Once these and other relevant determinations are made, employers should clearly and effectively communicate any changes to affected employees.

If you would like help in evaluating your company’s options, have any questions about compliance, or need assistance navigating these changes, please contact our Labor & Employment Law Practice Group. We encourage you to subscribe to our Labor & Employment E-Briefs to get the latest HR news, tips, and updates.